How to Analyze an Investment Property: A Complete Guide for First-Time and Experienced Investors

- Jan 29, 2026

- 3 min read

How to Analyze an Investment Property: A Complete Guide for First-Time and Experienced

Investing in real estate can be one of the most powerful ways to build long-term wealth. However, successful investing starts with properly analyzing an investment property before you buy. From understanding cash flow and financing options to leveraging professional property management, the right strategy can turn a good deal into a great investment.

At All County® Property Management, we have helped thousands of investors—from first-time buyers to seasoned professionals—build profitable rental portfolios across the country. In this guide, we’ll walk you through how to analyze an investment property, explore creative financing strategies, and explain how professional property management can significantly increase your bottom line.

Step 1: Understand Your Investment Goals

Before running numbers, clarify your objectives. Are you focused on:

-

Monthly cash flow

-

Long-term appreciation

-

Tax advantages and depreciation

-

Building a retirement income stream

-

Portfolio growth and leverage

Obtaining Long-Term Wealth Through Real Estate Investing

Many successful investors work with All County® offices to define investment criteria based on local market data, rental demand, and long-term growth trends.

Step 2: Analyze Cash Flow and Operating Numbers

Strong cash flow is the foundation of a successful rental investment.

Key areas to review:

Rental Income

-

Market rent (not just current rent)

-

Vacancy assumptions (typically 5–10%)

Operating Expenses

-

Property taxes and insurance

-

Maintenance and repairs

-

HOA fees (if applicable)

-

Utilities (if owner-paid)

-

Capital reserves

-

Professional property management fees

All County Property Management Services

Step 3: Evaluate the Market and Neighborhood

Even a great property can be a poor investment in the wrong market.

Smart investors analyze:

-

Job growth and economic stability

-

Population growth and migration trends

-

Rental demand and vacancy rates

-

School districts and amenities

-

Landlord-tenant regulations

All County® offices across the U.S. help investors identify strong rental markets and micro-neighborhoods with high demand and more predictable long-term performance.

Step 4: Explore Creative Financing Options

Creative financing can help investors acquire more properties with less cash and improve returns.

Common strategies include:

-

Seller financing

-

Subject-to financing

-

House hacking

-

Partnerships

-

DSCR and portfolio loans

Step 5: Factor in Tax Benefits and Long-Term Wealth

Real estate offers powerful tax advantages that improve after-tax returns.

Tax Benefits of Rental Property Ownership

Includes:

-

Depreciation

-

Expense write-offs

-

1031 exchanges

-

Mortgage interest deductions

The All County® Difference: How Professional Property Management Increases Your Bottom Line

Professional property management is not just a convenience—it is a profit strategy.

Full Service Property Management

How All County® improves ROI:

-

Higher quality tenant placement

-

Market-driven rent pricing

-

Reduced vacancy time

-

Vendor cost control

-

Compliance and risk management

-

Scalable systems for growth

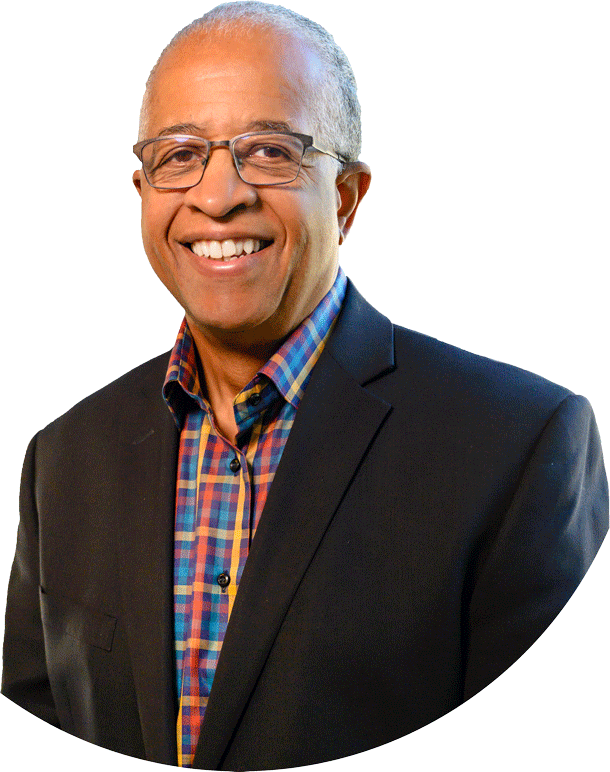

Learn from Sandy Ferrera: Obtaining Long-Term Wealth Through Real Estate

All County® founder Sandy Ferrera has spent over 35 years helping investors and property owners build wealth through real estate.

Meet Sandy Ferrera – Author, Investor, and Founder of All County Property Management

Her book shares proven strategies for:

-

Building sustainable rental portfolios

-

Understanding cash flow and leverage

-

Avoiding common investor mistakes

-

Using systems and professionals to scale

-

Creating passive income for financial freedom

How All County® Helps First-Time and Experienced Investors Succeed

Whether you are buying your first rental or expanding a portfolio, All County® provides:

-

Local market expertise

-

Rental pricing and analysis

-

Tenant placement

-

Full-service property management

-

Ongoing performance optimization

Find Your Local All County Office

Final Thoughts: Analyze Smarter, Invest Better

Learning how to properly analyze an investment property is one of the most important skills for building long-term wealth. By combining smart financial analysis, creative financing, and professional property management, investors can dramatically improve both short-term cash flow and long-term portfolio performance.

Ready to hire a

property manager?

With 83 locations across the U.S. servicing more than 30,000 residential properties, our experts are ready to help provide the best property management experience.

Find a Property Manager